The IRS also uses W-2. IRS Form W-4 tells your employer how much federal income tax to withhold from your paycheck.

Worksheet All About Dogs Concluding Statement Wraps Or Summarizes The Main Idea Of The Paragraph Wr Writing Opinion Pieces Topic Sentences Opinion Writing

Employers use W-2s to report FICA taxes for employees.

. Form W-2 reflects your income earned and taxes withheld from the prior year to be reported on your income tax returns. Sales tax is calculated. It can also include other information such as deferred compensation dependent care benefits contributions to a health savings account and tip income.

Shows how much a. The chart shows taxable income. The Receiver explains why the community used Climate Control to eliminate snow citing examples of times when people.

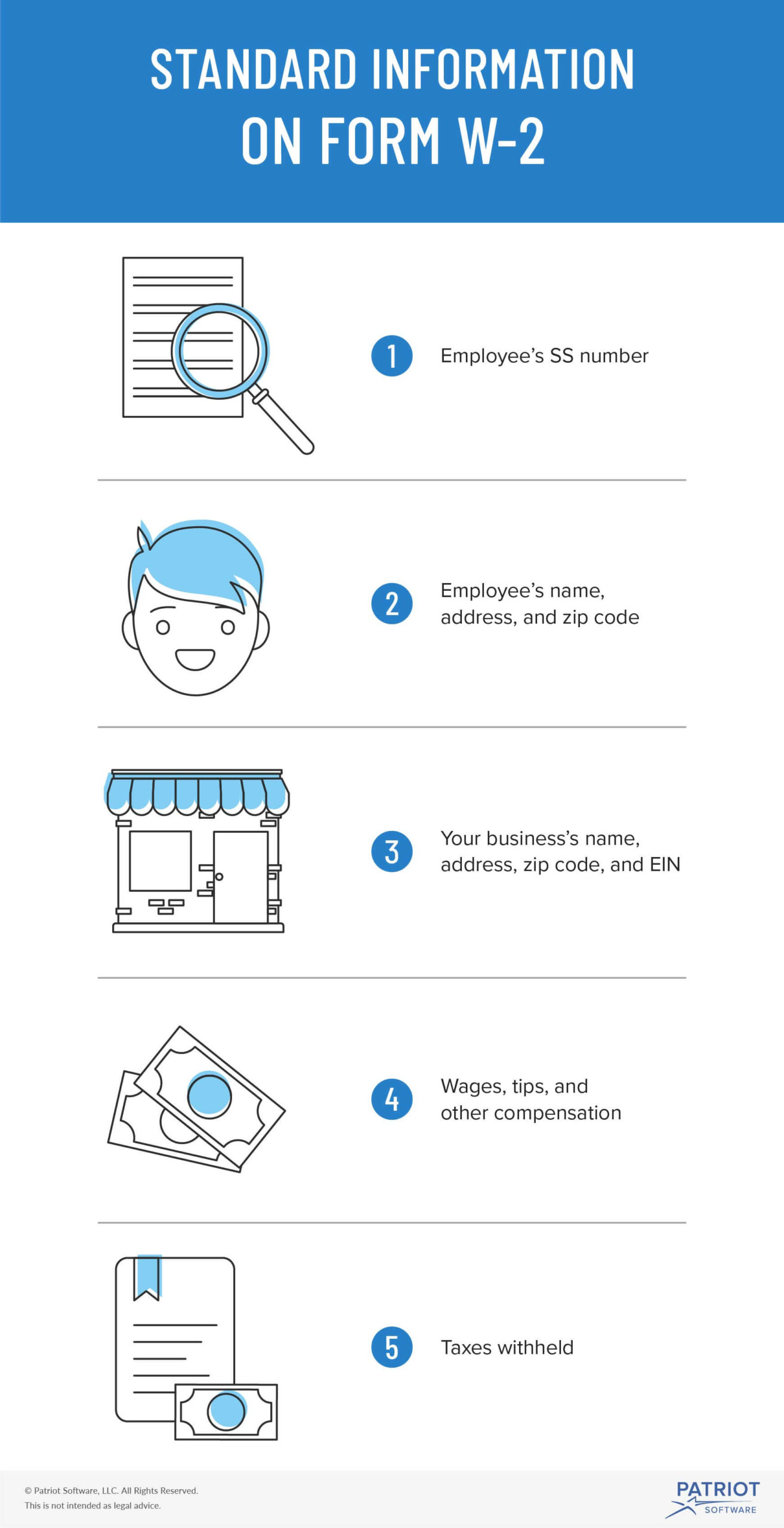

A tax collected on the purchase price of goods or services. Property taxes are based on. Employers must complete a Form W-2 for each employee to whom they pay a salary wage or other compensation as part of the employment relationship.

A W-2 doesnt make adjustments for the current tax season. One advantage they have over many tax. W-2 forms are a critical part of many peoples tax-preparation process as they report wages paid and taxes withheld by an employer over the course of a year.

What is the purpose of form W-2. How much a property is worth. Using a percentage of the price of an item.

Employers provide this forms for their employees so that. This form contains details of the employees salaries and their tax deductions from salaries. Jonas and the Receiver read about snow and other types of weather not found in the community.

An employer must mail out the Form W-2 to employees on or before January 31. In regards to the conversation around W2 vs W4 the W-2 recaps past events and payments. The employer needs to send these forms to his employees and the Internal Revenue Service IRS at the end of the year.

It reflects money earned over the last twelve months and how much payroll tax has been covered. If a home is valued at 250000 and the property tax rate is 2 percent how much will the owners pay in property taxes. Wed Jul 13 2016 The image shows a W-2 formWade and2012Which best describes the purpose of this document It shows how much a person paid in taxes and howmuch more is duet shows how much a person earned and how muchwas withheld in taxesIt shows how much a person earned and how much taxis to be refunded.

The IRS requires employers to report wage and salary information for employees on Form W-2. The W-2 form lists the wages you paid the employee throughout the year. A W2 form is primarily used to summarize an employees earnings and tax deductions for the year.

The W-2 form is a form that is required by every employer for his employees. So correct option is - Shows how much a person earned and. Form W-2 is an Internal Revenue Service tax form used in the United States to report wages paid to employees and the taxes withheld from them.

A W-2 form is an annual wage and tax statement that is issued by an employer. A W-2 form is a statement that you must prepare as an employer each year for employees showing the employees total gross earnings Social Security earnings Medicare earnings and federal and state taxes withheld from the employee. Amounts removed from gross income to pay for taxes and other expenses.

The purpose of a W2 form is to report salary and wage information for employees. You can also submit a new W-4 to your HR or payroll department when you have a life event that affects your taxes eg getting married or divorced or having a baby or if you paid too little or too much in taxes. Youll be asked to fill one out when you start a new job.

Information about Form W-2 Wage and Tax Statement including recent updates related forms and instructions on how to file. Form W-2 shows an employees gross wages and withheld taxes. The total income received from an economic plan.

Your W-2 also reports the amount of federal state and other taxes withheld from your paycheck. In addition to federal income tax many people also. Which statement best summarizes chapter 11 the Giver 1.

Jonas experiences tiny pinpricks of snow that touch his body and melt on his tongue. Form W-2 is filed by employers to report wages tips and other compensation paid to employees as well as FICA and withheld income taxes. A tax on the value of land buildings cars and other kinds of personal assets.

What Is A W 2 Form Definition And Purpose Of Form W 2

0 Comments